Disney Hit With Major Investor Uproar Following Jimmy Kimmel Drama

In the wake of Disney’s controversial decision to suspend Jimmy Kimmel Live!, the company has found itself embroiled in more than just media criticism. While many people were quick to voice their support for Kimmel, some of the loudest voices are coming from an unexpected place: Disney’s own shareholders.

The suspension, which stemmed from comments made by Kimmel about Charlie Kirk and Donald Trump, has sparked accusations from investors who claim that Disney’s actions have led to financial damage and a breach of fiduciary responsibility.

Related: The Business Behind Disney Shelving Jimmy Kimmel

The situation began on September 17 when Disney made the decision to pull Jimmy Kimmel Live! from the air after Kimmel’s comments about Charlie Kirk and Donald Trump. This move came after NexStar Media and Sinclair Broadcasting, two major affiliates, informed Disney that they would not air the show due to Kimmel’s remarks.

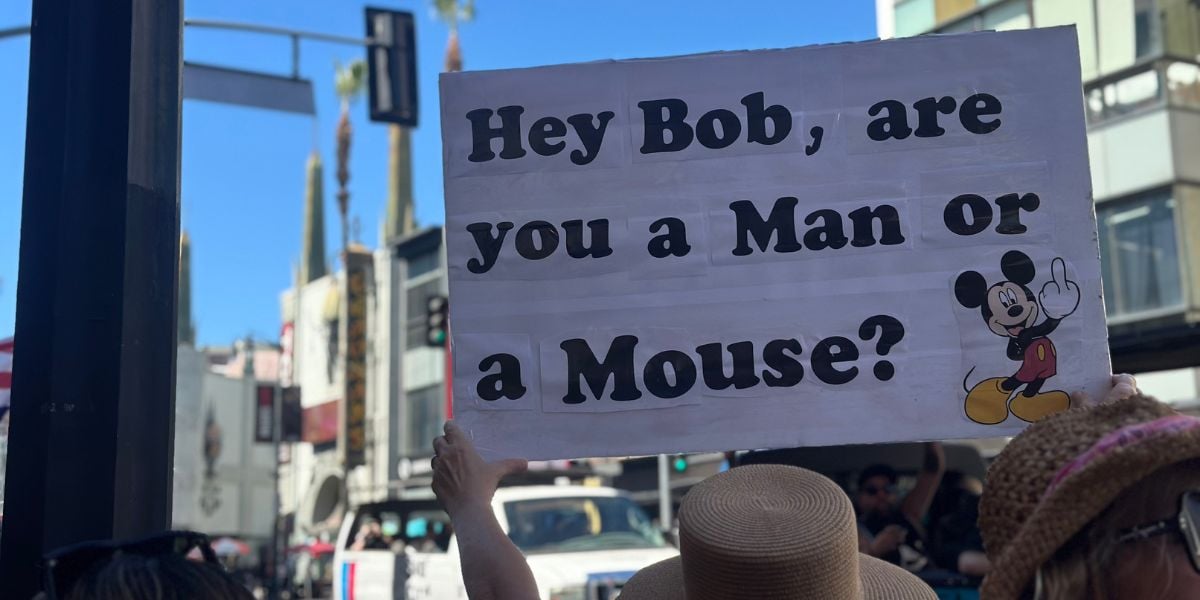

The backlash was swift, with Disney facing public criticism from several prominent individuals, including former President Barack Obama, former Disney CEO Michael Eisner, and high-profile actors like Mark Ruffalo and Tom Hanks. Protests even erupted outside Disney’s Burbank studio lot.

Following the suspension, Kimmel and his legal team began discussions with Disney about his return to the airwaves. However, Sinclair Broadcasting demanded that Kimmel apologize to Charlie Kirk’s family in exchange for agreeing to air the show. Kimmel, however, refused to offer an apology, claiming that his comments had been “mischaracterized” and stating that he would not “kowtow to the outrage.”

Disney, facing pressure from all sides, made an announcement on September 22 that Jimmy Kimmel Live! would return to the air on September 23, five days after the suspension. Despite this, the company was still facing significant criticism, not just from the public but also from within its own ranks.

According to a report from Semafor, a group of Disney shareholders has now accused the company of “breaching its fiduciary responsibility to investors” by prioritizing “improper political and affiliate considerations” over the company’s best interests.

Related: Disney Stock Takes a Hit as Kimmel Suspension Sparks Streaming Chaos

In their letter, the shareholders acknowledged Disney’s decision to reinstate Kimmel but expressed concern over how the initial suspension was handled. They stated:

Although we are pleased that ABC did the right thing and put Jimmy Kimmel back on the air last night, due to the Trump administration’s continued threats to free speech, including with respect to ABC, we are writing to seek transparency into the initial decision to suspend him and his show.

There is a credible basis to suspect that the Board and executives may have breached their fiduciary duties of loyalty, care, and good faith by placing improper political or affiliate considerations above the best interests of the Company and its stockholders.

Related: ‘The View’ Weighs In After ABC’s Jimmy Kimmel Shake-Up Leaves Fans Furious

The group of investors, which includes the American Federation of Teachers and Reporters Without Borders, is demanding transparency from Disney and seeking access to the company’s “corporate books and records” to investigate the potential wrongdoing.

According to the rules governing shareholder rights in Delaware, where Disney is legally incorporated, investors are entitled to review certain corporate records to assess whether their interests have been harmed. However, they are not allowed to access day-to-day management decisions made by executives like Bob Iger or Dana Walden. This means the group can examine board-level decisions and communications, but not the internal discussions that led to the suspension.

The shareholders are particularly concerned about the financial impact of Kimmel’s suspension, which they believe caused damage to Disney’s brand and reputation.

Related: Trump’s Latest Clash With ABC Leaves Reporters Stunned

The group has requested documents detailing the effect of Kimmel’s removal on Disney’s revenue, particularly in the areas of ad sales and streaming services. Additionally, they are asking for a clearer understanding of how decisions are made regarding “politically sensitive programming” and what role affiliate stations like NexStar and Sinclair played in the situation.

The fallout from suspending Jimmy Kimmel Live! sparked criticism as an attack on free speech, triggered boycotts and union support for Mr. Kimmel, and caused Disney’s stock to plummet amid fears of brand damage and concerns that Disney was complicit in succumbing to the government overreach and media censorship.

The financial consequences of the suspension were also felt in Disney’s stock price, which dropped just over 2%, equating to a loss of approximately $4.4 billion. The shareholders argue that this drop in value is directly tied to the company’s handling of Kimmel’s suspension, with investors fearing further damage if Disney continues to let political pressure influence its programming decisions.

In response to these shareholder concerns, Disney is now facing additional scrutiny over its handling of the situation. While Kimmel has returned to his late-night show, the fallout continues to reverberate throughout the company, with shareholders insisting on full transparency regarding the decisions made behind closed doors.

The question now remains: Do Disney’s shareholders have a legitimate claim about the company’s financial management, or are they overreacting to a complex situation? Do you believe Disney made the right decision in suspending Kimmel, or did the company give in to outside pressures? Let us know your thoughts in the comments below!