Disney’s Streaming Losses Deepen as ESPN Loses Key Property

Disney’s Streaming Strategy Faces Tough Reality

As the streaming wars continue to heat up, Disney faces mounting challenges with subscriber losses impacting multiple platforms, including Disney+. The media giant has been pressured to improve profitability across its portfolio, notably with its flagship streaming service.

CEO Bob Iger has emphasized shifting the company towards sustainable profit. This operational focus coincides with a crucial component of Disney’s streaming strategy: ESPN, a valuable asset for drawing in and retaining viewers.

Streaming Subs Declining Across Platforms

Recent reports indicate that declining subscription numbers are hitting various streaming platforms, with Disney finding itself among the companies grappling with this issue. The general shift in consumer behavior suggests a saturation in the streaming market, prompting viewers to reconsider their subscriptions. Disney’s strategy aims to counter this downward trend through a mix of original content and leveraging existing franchises, though ESPN’s loss of key sporting events creates an unexpected hurdle.

CEO Focused on Profitability Improvements

Bob Iger’s leadership has steered Disney towards a more financially accountable path. While Disney+ shows signs of profitability, the loss of robust content — especially from ESPN — could threaten this newfound stability. ESPN’s extensive portfolio of live sports has traditionally helped drive subscriptions, making its role integral to Disney’s collective streaming success.

ESPN’s Role Integral to Streaming Success

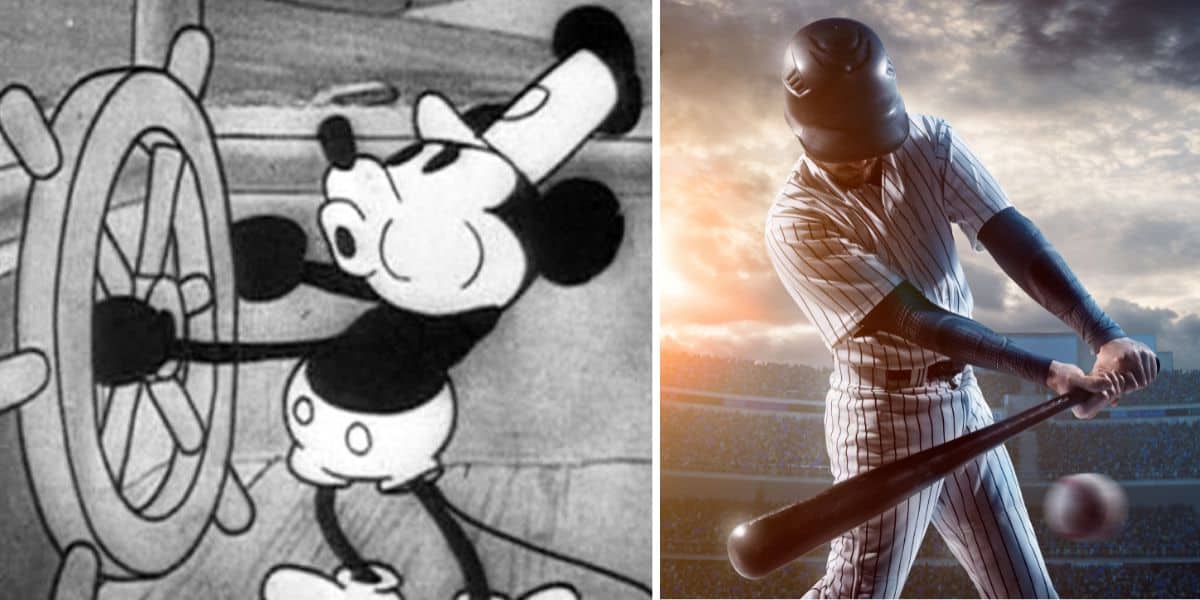

ESPN’s network is synonymous with live sports programming, an asset that sets it apart in the competitive streaming landscape. Mossing Major League Baseball (MLB) programming could significantly impact ESPN’s potential to attract and retain viewers, especially during peak seasons. The financial ramifications of this loss may echo throughout Disney’s broader strategy.

ESPN Loses Major Sports Partnership

This week, ESPN and MLB jointly announced the termination of their longstanding broadcast relationship. The decision marks the end of an era that included significant events like Sunday Night Baseball, a staple on the network since 1990. The negotiations, which failed to yield a contract renewal before the March 1 deadline, uncovered significant disagreements about financial terms.

End of MLB Broadcast Relationship

ESPN has reportedly been paying MLB approximately $550 million annually to carry its games. As ESPN sought to renegotiate this figure, MLB expressed dissatisfaction with the perceived disparities in broadcasting contracts with other networks that charged less. The situation culminated in a split that will create a noticeable void in ESPN’s summer lineup when baseball traditionally dominates viewership.

Financial Implications for ESPN

Losing MLB adds financial uncertainty to ESPN’s already vulnerable position. The network will not only miss out on significant advertising revenue but also risk alienating a portion of its viewer base who tune in primarily for baseball. New programming is needed to fill this gap significantly as Disney shifts its focus toward a streaming-only platform.

Impact on Future Programming Lineup

The absence of MLB could significantly alter ESPN’s programming lineup for the 2026 season. Without this key content, the network may find it challenging to keep viewers engaged, particularly in the summer months when live sports options are limited. While ESPN continues to hold rights to other major sports, the loss of MLB is a notable blow to its value proposition.

Upcoming Changes to ESPN’s Offerings

In light of these developments, ESPN plans to launch a new streaming-only platform. This move is anticipated to coincide with shifts in how live sports are consumed. However, without a comprehensive strategy to offset MLB’s loss, the network must act swiftly to maintain its competitive edge.

New Streaming-Only Platform Plans

ESPN’s new platform aims to attract a younger audience and adapt to evolving consumer preferences.

However, the timing couldn’t be worse, as the tournament programming and other offerings may not be enough to counterbalance the loss of ratings and viewership due to MLB’s departure.

Scheduling Adjustments Without MLB

The absence of MLB presents scheduling challenges for ESPN. Programming that previously featured regularly scheduled baseball games must be replaced or restructured. Viewers may see additional content from other sports, but maintaining viewer interest during the summer remains uncertain.

Maintaining Viewer Engagement

Sports viewership is notoriously fickle; ESPN must innovate to keep its audience engaged. Strategies may include enhanced digital content, promotional partnerships, and perhaps even exploring exclusive streaming agreements with other sports leagues.

Industry Reactions and Future Prospects

ESPN’s decision to part ways with MLB has sent shockwaves across the sports broadcasting ecosystem. This development raises questions about the future of sports partnerships and their influence on viewer engagement.

Competitors Eyeing MLB’s Broadcast Rights

While ESPN grapples with its ongoing transformation, competitors are keenly eyeing the newly available MLB broadcast rights. This scenario opens up opportunities for other networks and streaming services to compete for significant sports content.

Shifts in Sports Broadcasting Landscape

The departure of MLB from ESPN’s offerings signifies broader changes in the sports broadcasting landscape, indicating that traditional agreements are becoming less stable. The shift towards streaming has altered the dynamics, with various players seeking to cement their positions.

Potential Strategies for Recovery

Disney and ESPN’s strategic recovery may involve new acquisitions, revamped programming, or innovative digital integrations. The industry will be closely monitoring how ESPN adjusts to these challenges and whether it can successfully adapt without the financial stability provided by MLB’s broadcasts.

In summary, ESPN’s loss of MLB is a significant development, posing challenges to its streaming strategy amid broader subscriber declines for Disney’s platforms. The next steps taken by both ESPN and Disney could define their future in the competitive streaming environment.